Autumn Budget 2021: Five Key Announcements for Small Businesses

Posted 3 years ago by Tracy

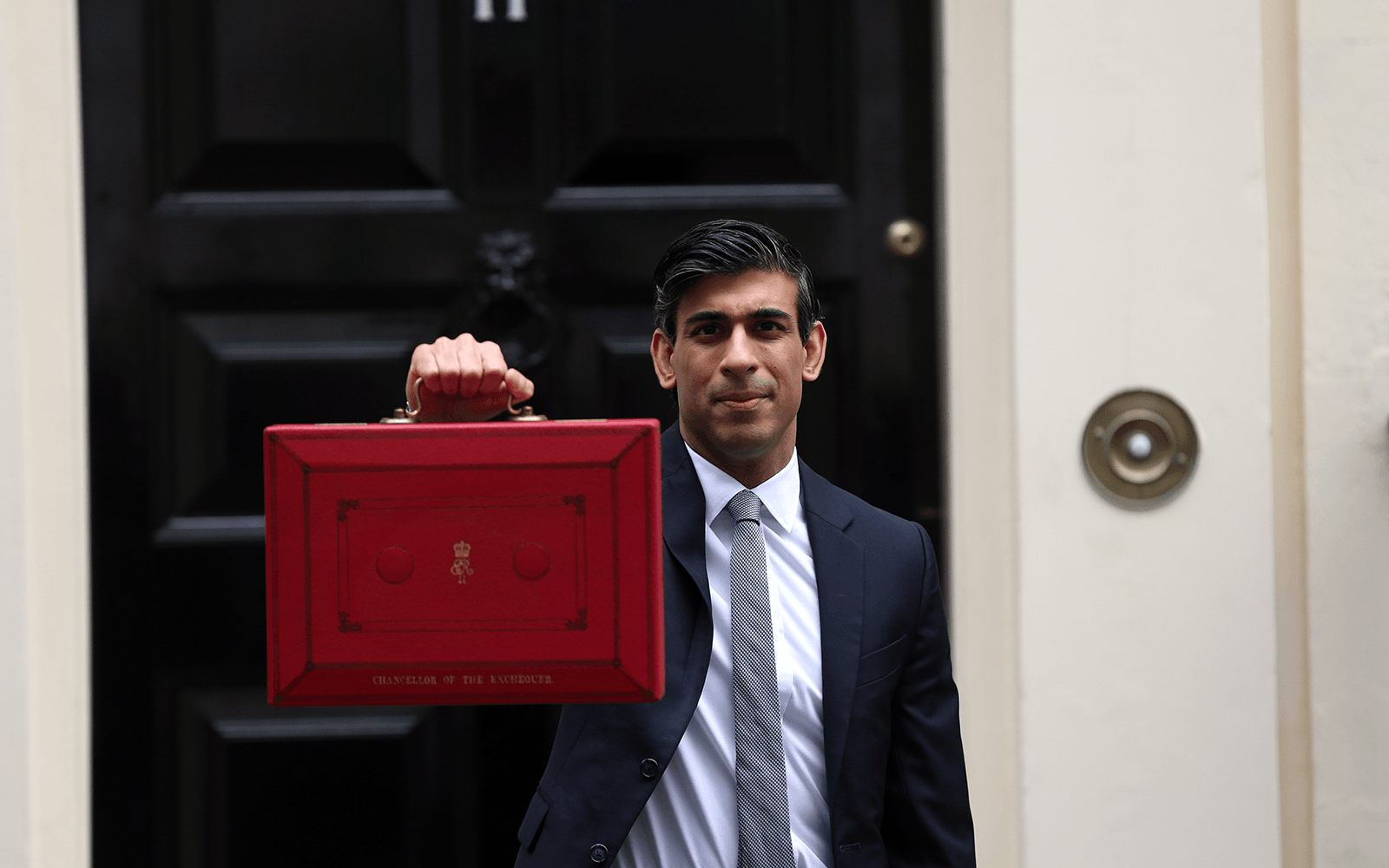

As chancellor Rishi Sunak delivered his latest Budget on 27 October, it seemed like many of the big announcements had already been revealed. However, there was still plenty in there that would affect small businesses across the UK, both positively and negatively.

Business rates

One of the biggest announcements concerned changes to business rates. After some speculation that any changes would be delayed, Sunak announced that the government will not be abolishing business rates, but retail, leisure and hospitality businesses will get a 50% discount for one year. Pubs, music venues, cinemas, restaurants, hotels, theatres and gyms are all eligible. The maximum discount will be £110,000.

Looking ahead and from 2023, business rates will be re-evaluated every three years, down from the current five years, in an effort to make the system fairer. A green investment relief is also set to be introduced to encourage businesses to adopt green technologies such as solar panels.

National Living Wage increase

The chancellor also confirmed a rise in the National Living Wage, paid to those aged 23 and over. From April 2022, it will increase from £8.91 to £9.50 an hour – up 6.6%. The minimum wage for people aged 21-22 will also rise from £8.36 to £9.18 an hour, and the Apprentice Rate will increase from £4.30 to £4.81 an hour.

Angel investor fund

The Autumn Budget was also used to announce £150m of funding for regional angel investors to help small businesses outside of London and the south east. The Regional Angels Programme will connect investors with entrepreneurs to help them get their businesses up and running.

Fuel duty freeze

With fuel prices at the highest level in eight years, there was welcome news that the planned fuel duty increases have been cancelled. The tax will remain at 57.95p a litre on petrol and diesel for the twelfth year in a row.

National Insurance rise

As announced in September, National Insurance rates for both employees and the self-employed will rise by 1.25 percentage points across earnings bands from April 2022. The government is also set to increase dividend tax rates by 1.25 percentage points at the same time.

Further Reading

Key Takeaways from Spring Budget 2023: Corporation Tax Rises and Investment Zones

Budget 2021: What It Means for Small Businesses

Late Payment Window to Small Suppliers Reduced to 30 Days in the Uk