Blog Archive for 2021

Autumn Budget 2021: Five Key Announcements for Small Businesses

Tracy | 4 years ago

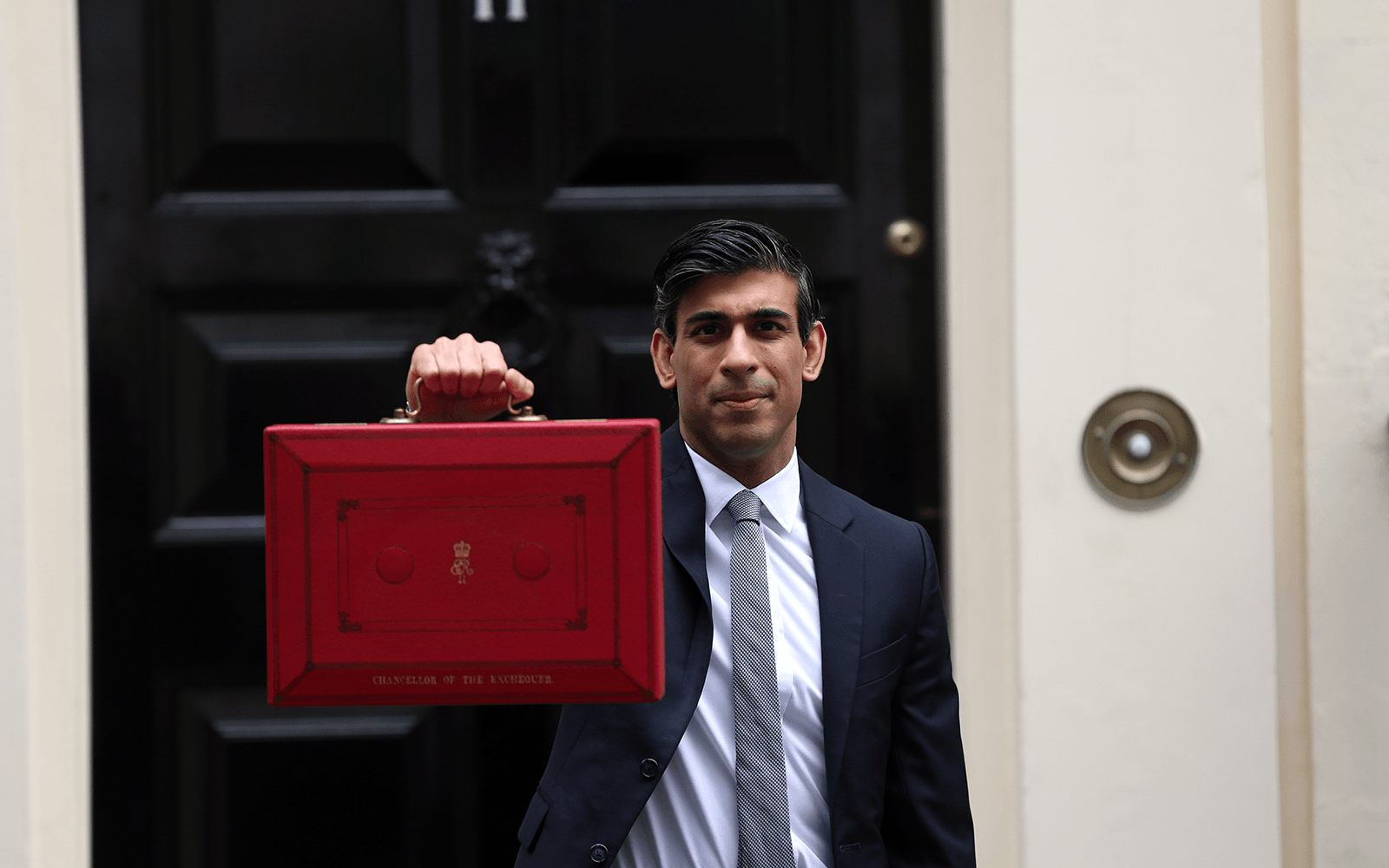

As chancellor Rishi Sunak delivered his latest Budget on 27 October, it seemed like many of the big announcements had already been revealed. However, there was still plenty in there that would affect small businesses across the UK, both positively and negatively.

Hospitality VAT rate set to rise to 12.5%: How to manage the change in AccountsPortal

Alison | 4 years ago

From 1 October 2021, the VAT rate for businesses in the tourism and hospitality sector will increase to 12.5% as the sector transitions from the reduced rate of 5%. Fortunately, managing this change in AccountsPortal is quick and easy, here's what you need to know.

A Guide to Capital Gains Tax for Small Businesses

Tracy | 4 years ago

Capital Gains Tax (CGT) is a tax on the profit made when you dispose of an asset that has increased in value. So, if you sell, gift or swap an asset and profit from it, you may have to pay CGT on the gain.

How to Register as a Sole Trader

Tracy | 4 years ago

Once you’ve decided that operating as a sole trader is the right legal structure for your business, it’s important to follow all the necessary steps to ensure you’re properly registered and able to start trading. Fortunately, as a sole trader, this is a relatively straightforward process.

How To Manage Out Of Pocket Expenses

Gidon | 4 years ago

When running a business, you’ll likely come across regular small expenses that can be easier to pay for using your own cash rather than via the company account. However it’s essential to have a system in place to log, track and reimburse these small expenses so don’t become a big hassle.

A Guide to Sick Pay for the Self-employed or Company Directors

Tracy | 4 years ago

When self-employed or running a small business, taking time off sick can seem like an impossibility, but sometimes it simply cannot be avoided. If that time arises, being aware of your rights and the support you’re entitled to can make a huge difference during what is likely to be a stressful situation.

Should You Be a Sole Trader or a Limited Company?

Tracy | 4 years ago

When setting up a business, there are a lot of major decisions to be made. One of the more difficult, and one that can have a major impact on your success, is the structure and legal status of your business.

Ten Purchases You Didn't Know Were Tax-deductible

Alison | 4 years ago

It's important to know what counts as an allowable expense, and is therefore tax-deductible, for corporation tax purposes. Here are 10 of the less well-known tax-deductible purchases that apply whether you're a limited company, partnership or sole trader.

How to Leverage Technology and Automation to Support Your Firms Growth

Alison | 4 years ago

Technology and automation can be incredibly helpful in helping firms streamline their processes, attract customers and enable growth. However it can be difficult to know where to start. Here's our advice on the best tech for your accountancy business.

What is a Director’s Loan, and How Do I Use It?

Tracy | 4 years ago

A director’s loan can be a useful way for a director to borrow from or loan money to their limited company. While the concept may seem simple, in truth, it can be a complex process, requiring robust admin and potentially carrying risks such as tax penalties if used incorrectly.

Ten End of Tax Year Changes That You Need to Know About

Tracy | 4 years ago

From changes to the personal tax allowance to an increase to tax rates for company vehicles, as well as the various COVID-19-related initiatives recently announced by Chancellor Rishi Sunak, there’s plenty to be aware of to make sure you’re properly prepared for the new tax year.

How to Manage VAT in AccountsPortal

Tracy | 4 years ago

When running a small business, one of the most daunting areas for many can be managing their tax affairs. With complex, changing rules and serious fines should mistakes occur, managing VAT and other taxes can be a challenge, so the importance of maintaining accurate records and meeting filing deadlines should not be underestimated.

How to Build Your Accountancy Team

Tracy | 4 years ago

As businesses grow, many owners come to the realisation that additional support is needed to ensure they have full control and awareness of their financial situation. This could include hiring an accountant or bookkeeper or even bringing in a permanent member of staff.

Budget 2021: What It Means for Small Businesses

Tracy | 4 years ago

With the economic challenges brought on by the Covid-19 pandemic front of mind for many, this year's Budget has been much anticipated. Chancellor Rishi Sunak was tasked with kickstarting economic recovery and protecting jobs while also recognising the need to begin repairing the public finances.

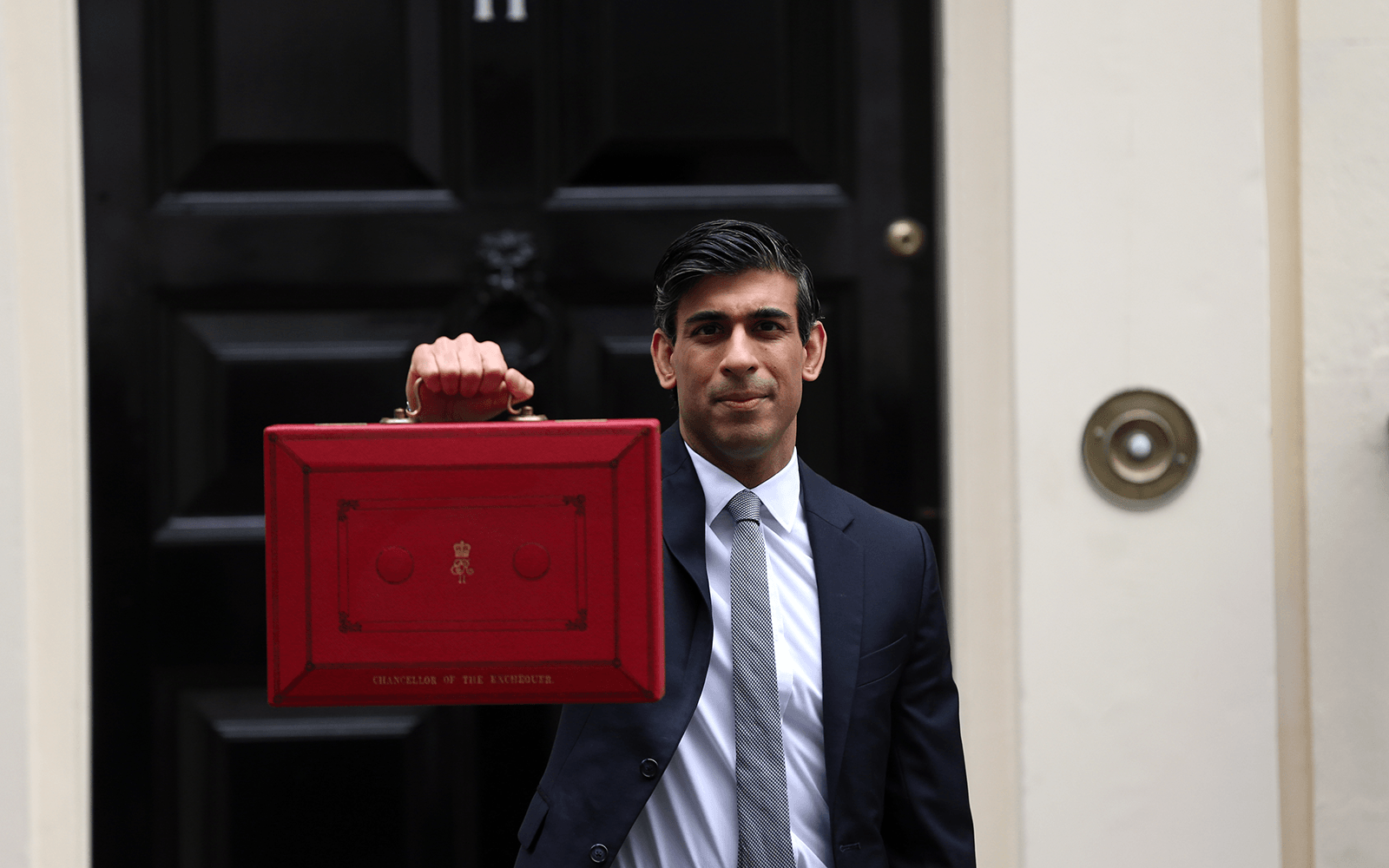

How to Control User Permissions and Why They’re Important

Tracy | 4 years ago

Maintaining the integrity of your financial accounts is crucial, no matter the size or scope of your business. However, ensuring people, whether employees or external stakeholders, can efficiently complete their duties is also central to a business’ day-to-day operations. It is for these reasons that properly utilising user permissions in your accounting software is so important.

What’s the Difference Between a Debtor and a Creditor?

Tracy | 4 years ago

‘Debtors’ and ‘creditors’ are common terms when it comes to bookkeeping, but it’s important to be clear on the difference between the two and how both need to be accounted for in your financial records.

How to Prepare for the Construction Industry Vat Reverse Charge

Gidon | 4 years ago

The VAT domestic reverse charge for building and construction services will come into effect on 1 March 2021, bringing with it significant changes to the way in which VAT is handled for certain kinds of construction services in the UK.

The VAT domestic reverse charge builds on the existing Construction Industry Scheme (CIS) which requires contractors to deduct money from sub-contractors’ payments for tax and NI purposes.

How to Build Your Accountancy Brand

Alison | 4 years ago

Whether you’re looking to build an accountancy brand from scratch or refresh your current offering, there are a number of steps you can take to ensure you’re offering a consistent and reliable brand experience that clients will come to recognise and trust.

How to Manage Inventory and Stock in AccountsPortal

Tracy | 4 years ago

A key benefit of accounting software is that it makes what can be a complex and time-consuming task that much easier. However, when it comes to running a business there are always more things that need to be done and, as every business sells a product or service, managing inventory can be one of the more challenging elements.

How to Retain Accountancy Clients

Alison | 5 years ago

Perhaps even more important than winning new business, retaining clients is key to any business's long-term success. Research suggests it costs significantly more to win new business than keeping existing clients and the success rate of selling to a client you have can be as high as 70% compared with only 20% when it comes to a new prospect.

Late Payment Window to Small Suppliers Reduced to 30 Days in the Uk

Tracy | 5 years ago

The UK government has announced a crackdown on large businesses that take too long to settle invoices, in a move that should help to ease the cash flow issues faced by many smaller companies.

How to Know When You Need to Hire an Accountant

Alison | 5 years ago

Seeking help from an accountant can be a good idea no matter what stage of development your company is at. however, it can seem like an additional expense that may be difficult to justify. So, what are the signs that your business would benefit from employing the services of an accountant?

A Guide to the Profit and Loss Account

Tracy | 5 years ago

Along with the Balance Sheet and Cash Flow Statement, the Profit and Loss Account forms the basis of every company’s accounts, providing a snapshot of your incomings and outgoings over time, helping to provide a clear picture of how a business is performing.

Off-payroll Working Reforms (IR35) Rules Take Effect April 2021

Alison | 5 years ago

On 6 April 2021, major changes to the off-payroll working rules, known as IR35, are set to be introduced, following a 12-month delay due to the COVID-19 pandemic.

Impact of Brexit on VAT with Effect from 1 January 2021

Gidon | 5 years ago

With the Brexit transition period ending on 31 December 2020, new rules covering customs and tax have been introduced which affect how VAT-registered businesses in the UK trade with the EU and the rest of the world.

This article covers the changes that have been introduced, and how AccountsPortal caters for the new requirements.